The stablecoin bill is in hand, and Wall Street bankers are restless

Stablecoins have formally entered the US market, expanding the potential for American crypto finance.

Just last night, the U.S. House of Representatives passed both the GENIUS Act and the CLARITY Act, providing stablecoins with a formal regulatory framework and setting clear supervision benchmarks for the entire digital asset industry. The White House then announced that Trump himself will sign the GENIUS Act this Friday. From now on, stablecoins aren’t unregulated experiments—they’re poised to become fully recognized by U.S. law as official monetary instruments backed by the federal government.

Almost simultaneously, the Federal Reserve, FDIC, and OCC issued their first-ever joint guidance clarifying that U.S. banks are permitted to offer crypto asset custody services to clients. Wall Street’s major banks and institutions are ready to seize this moment.

Traditional Banks Take the Stablecoin Lead

Bank of America (BoA), the nation’s second-largest bank, has confirmed it’s actively preparing stablecoin products and exploring partnerships with other financial institutions for co-development. “We’re ready, but we’re waiting for greater market and regulatory clarity,” the bank stated.

“We’ve done a tremendous amount of groundwork,” said BoA CEO Brian Moynihan. “Right now, we’re deepening our understanding of client demand and will introduce stablecoin products at the right moment—potentially in collaboration with other financial institutions.”

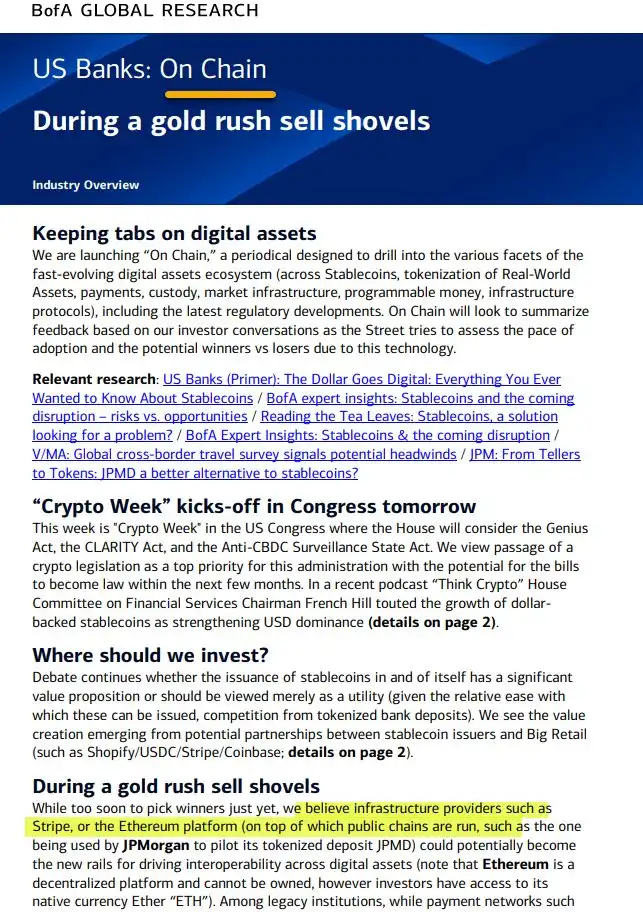

At the same time, BoA has launched its “On Chain” research weekly with a focused eye on stablecoins, real-world assets (RWA), payments, settlement, and infrastructure. The launch comes during a pivotal week as Washington lawmakers debate the GENIUS Act, CLARITY Act, and legislation opposing central bank digital currency surveillance—all of which could shape U.S. stablecoin and digital infrastructure policy for years to come.

BoA’s research team emphasized, “We’re focused on real innovation that transforms financial infrastructure, not on hype.” They highlighted Ethereum’s pivotal role in powering digital asset interoperability and revealed they’ve already run stablecoin pilots with mainstream retail platforms like Shopify, Coinbase, and Stripe—aiming to push stablecoins beyond their old use cases and create entirely new business models.

“Once regulations are clear, banks are ready to embrace crypto payments,” CEO Brian Moynihan reiterated.

Citi, too, is poised to move as soon as the opportunity arises.

Citi CEO Jane Fraser has made clear that the bank is aggressively advancing its stablecoin initiatives, viewing them as the future backbone of cross-border payments. Citi’s bet on stablecoins comes as global cross-border payment challenges—including high fees and slow settlements—have come to the fore. Hidden costs in cross-border transactions can reach 7%, and the traditional interbank network lags far behind on-chain solutions. Citi’s goal: build always-on, programmable new payment rails with stablecoins, so corporate clients can move money globally with low cost and high efficiency.

JPMorgan, one of crypto’s oldest Wall Street “regulars,” is moving even faster.

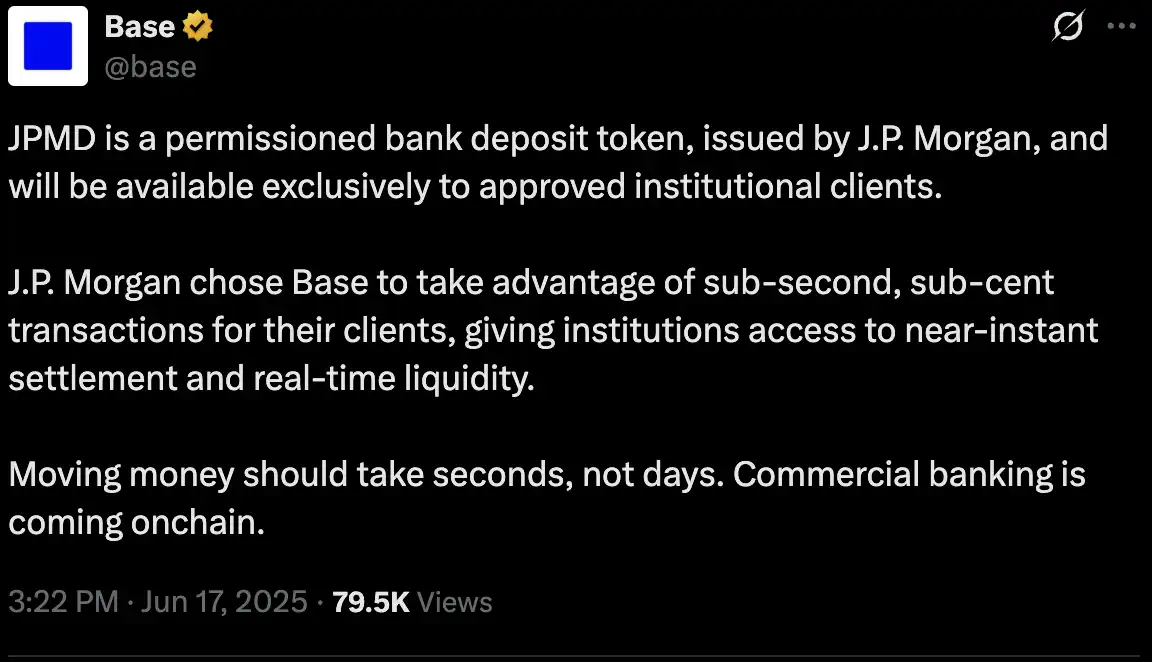

On June 18, JPMorgan announced a pilot deployment of a new deposit token, JPMD, on Coinbase-supported Base blockchain. Initially, only JPMorgan’s institutional clients will access the token, but following U.S. regulatory approval, broader use and more currencies are planned.

This is the first time a Wall Street bank has issued tokenized deposits directly on-chain—a critical step toward integrating traditional banking and the decentralized world. JPMD is a “permissioned deposit token” pegged 1:1 with JPMorgan U.S. dollar deposits, supporting 24/7 real-time transfers with transaction fees as low as $0.01, plus traditional protections such as deposit insurance and interest.

JPMD outpaces existing stablecoins in both regulatory compliance and institutional trust, and could bring unprecedented capital and institutional liquidity to the Base blockchain. “This isn’t just adopting crypto—it’s redefining banking,” said Naveen Mallela, head of JPMorgan’s blockchain division.

Across the American banking sector, the speed at which traditional banks are entering the stablecoin and on-chain space now far exceeds the crypto industry’s most bullish projections. A significant transformation in finance is underway.

The “Green Light” Is On: Can Traditional Banks Buy Bitcoin?

“The green light is on, traditional finance is racing in, and the walls between banks and crypto are coming down. This is highly favorable for the crypto market.”

As Profitz Academy founder Merlijn observed, on July 14 the Federal Reserve, FDIC, and OCC jointly issued guidance requiring banks offering these services to establish comprehensive risk management in key management, asset selection, cybersecurity, audit oversight, third-party custody, and compliance risk controls.

Although no new rules have been enacted, this is the first time regulators have clearly articulated their supervisory expectations for crypto custody. Crypto finance is moving from an unregulated environment to a regulated fast track—and traditional banks are no longer watching from the sidelines.

That signal quickly reverberated through the market. Wall Street giants have since unveiled their latest advances in stablecoin and crypto businesses, vying for leadership as the financial infrastructure is rebuilt. Simultaneously, crypto-native institutions like Circle and Ripple are actively pushing compliance to consolidate their global positions as worldwide regulatory frameworks take shape.

This means the boundaries among banks, crypto asset management, and trading platforms are beginning to blur. In fact, traditional banks are now directly vying with crypto-native asset managers and platforms for market share.

The Crypto Clash: Traditional Banks vs. Native Managers

On July 15, Standard Chartered became the world’s first systemically important bank (G-SIB) to offer spot Bitcoin and Ether trading to institutional clients. The new service, launching in London, Hong Kong, and Frankfurt, initially covers Asia and Europe, and aims for always-on, 24/5 availability—directly integrated with traditional FX platforms. Corporate and asset management clients can now buy and sell BTC or ETH just as easily as foreign exchange, choosing self-custody or third-party settlement as desired.

In fact, Standard Chartered has long built its digital asset custody and trading footprint via Zodia Custody and Zodia Markets; this time, it’s simply making all those capabilities fully accessible. Global Head of Digital Assets Rene Michau said the bank’s spot crypto services will start with BTC and ETH and will soon expand to more products—futures, structured products, NDFs—mirroring the business lines of crypto exchanges.

At the same time, JPMorgan, Bank of America, and others are preparing to launch crypto custody and related services. What once seemed impossible has quickly become reality: 12 months ago, you might have asked, “Will JPMorgan ever custody Bitcoin?” Now, the question is only “Which bank will win the biggest market share first?”

The new breed of “challenger banks” deserves attention as well. London-based Revolut, for example, derives much of its revenue from crypto trading and ultimately wants a U.S. banking license to break into the mainstream financial ecosystem.

Peter Thiel’s Silicon Valley Bank Ambitions

Beyond providing custody and competing for market share with crypto-native platforms, Wall Street’s most ambitious players are now targeting new footholds in account services and credit support.

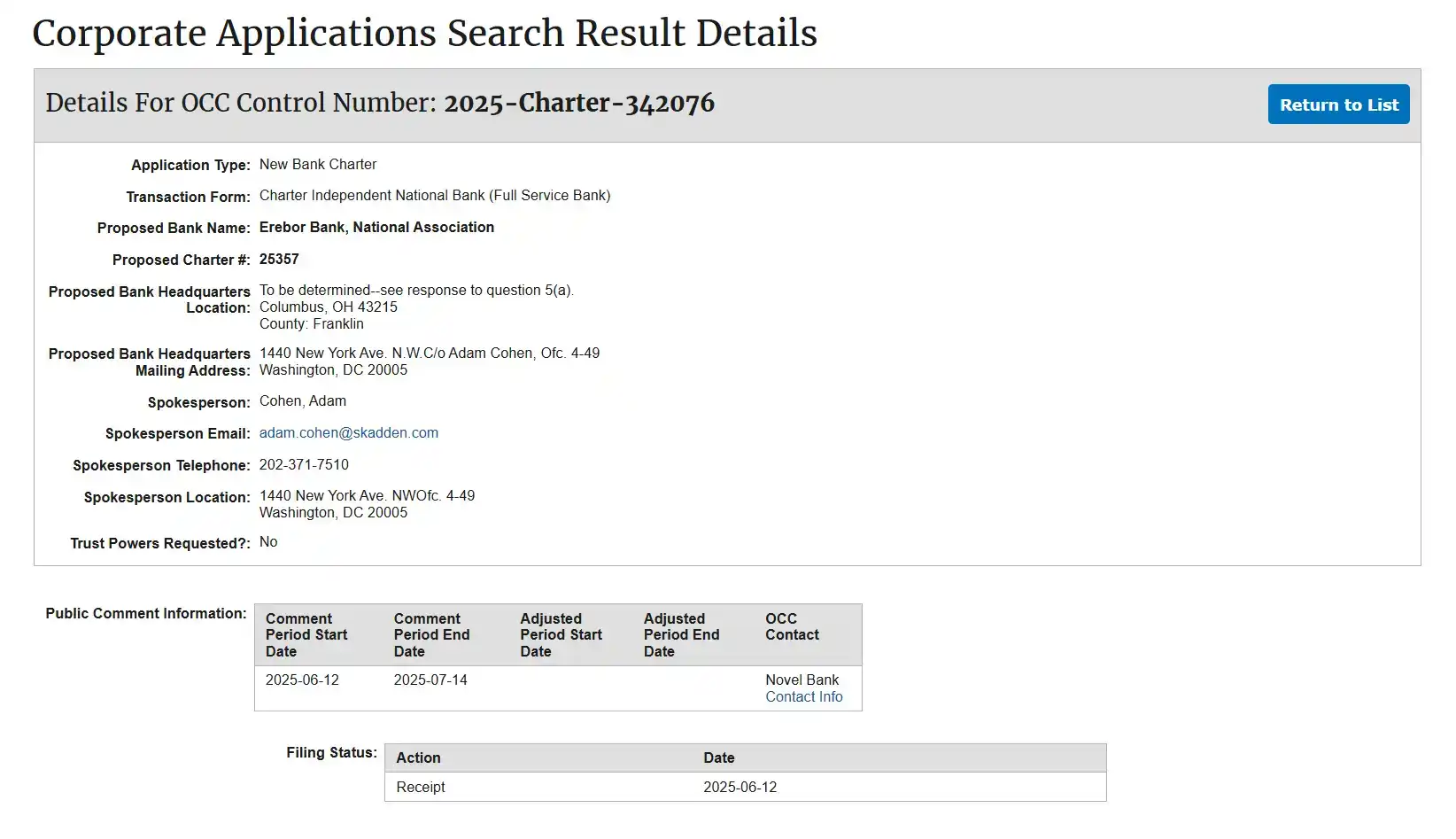

Major financial media have confirmed: Peter Thiel, along with tech billionaires Palmer Luckey and Joe Lonsdale, is co-founding a new bank called Erebor and has formally applied for a national banking charter from the OCC. Erebor is targeting startups in crypto, AI, defense, and manufacturing that mainstream banks have shunned, aiming to become the new Silicon Valley Bank after SVB’s collapse.

This venture features a distinct “Silicon Valley-political” tie-up: Peter Thiel (PayPal and Palantir co-founder, Founders Fund), Palmer Luckey (Oculus founder, Anduril co-founder), and Joe Lonsdale (Palantir co-founder, 8VC founder)—all major Trump 2024 donors and closely involved in the congressional push for the GENIUS Act.

According to Erebor’s filing with the OCC, Founders Fund will supply most of the capital. The three founders will serve only on the board, not in day-to-day management, which will be handled by a former Circle advisor and the CEO of compliance software firm Aer Compliance—deliberately separating politics from operations to emphasize Erebor’s status as a regulated institution.

Learning from SVB’s collapse, Erebor will enforce a 1:1 reserve ratio and limit loans to below 50% of deposits to prevent liquidity mismatches and credit excesses. Regulatory filings show stablecoin services will be core—offering custody, issuance, and redemption for regulated stablecoins like USDC, DAI, and RLUSD—building “the most compliant stablecoin trading institution,” creating legal, compliant fiat gateways and on-chain asset services for enterprises.

The bank’s target market is equally focused: innovative firms in crypto, AI, defense, and advanced manufacturing—often labeled “high-risk” by traditional banks—along with their employees and investors. Erebor will also serve “international clients”: entities needing U.S. dollar access for settlement or wishing to lower cross-border costs via stablecoins. By establishing “correspondent banking relationships,” Erebor aims to be the primary gateway to the U.S. dollar system.

Erebor’s business model is distinctly crypto-native: deposits and loans are collateralized by BTC and ETH with no traditional mortgages or auto loans, and it holds a small BTC/ETH balance on its own books for operational needs (e.g., gas fees) but avoids speculative trading. Most importantly, Erebor draws a strict regulatory line: it does not offer custody under a trust license, only on-chain settlement, and does not directly safeguard user assets.

In summary, Erebor is a next-generation Silicon Valley Bank. Favorable U.S. crypto policy could make Erebor the first fully compliant “USD relay bank” to custody USDC, RLUSD, and other stablecoins while facilitating federal settlement.

Related reading: “Peter Thiel Launching Erebor as an SVB Replacement“

National Bank Charters: The Next Crypto Banking Frontier

With stablecoin legislation finalized and the regulatory green light flashing in Washington, the next round of jockeying among Wall Street banks has begun.

The National Trust Bank Charter has become a key battleground, offering one of the highest-level licenses in U.S. finance and the clearest path for crypto asset firms, custodians, and stablecoin companies seeking mainstream acceptance.

U.S. banking rests on three core federal charters: National Bank, Federal Savings Association (FSA), and National Trust Bank. The first two are traditional banks and savings associations—high barriers, long histories. The Trust Bank Charter, however, is designed for trust, custody, and pension services and is a perfect fit for crypto custodians looking for compliance.

This charter’s strategic value is often underestimated: It serves as a national passport, allowing business in all 50 states without individual state-by-state licenses. It allows holders to offer institutional-grade asset custody, crypto safekeeping, corporate trust, and pension services—though it does not allow retail deposits or loans, which actually aligns with crypto custodians’ needs for asset safety, fiat custody, and regulatory transparency.

Crucially, the charter is issued directly by the OCC at the federal level. With it, crypto firms can apply for access to the Federal Reserve’s payment and clearing infrastructure, dramatically increasing liquidity and settlement efficiency.

Anchorage Digital: America’s First Crypto Custody Bank

Anchorage Digital was the first crypto asset manager to seize the opportunity.

Founded in 2017 in California, Anchorage Digital focuses on institutional-grade digital asset custody, serving funds, family offices, and exchanges with secure, compliant storage services.

Before 2020, crypto custody providers could only operate with state trust licenses (like New York’s BitLicense or a South Dakota trust), which provided limited business scope and reputational value.

But in 2020, the OCC welcomed a new pro-crypto leader—former Coinbase executive Brian Brooks—who opened the door for digital asset firms to apply for federal bank charters. Anchorage moved fast, submitting an exhaustive application covering KYC/AML, compliance, risk controls, and governance. On January 13, 2021, the OCC granted approval: Anchorage Digital Bank National Association officially launched—the first federally chartered digital asset trust bank in U.S. history.

This federal recognition catapulted Anchorage Digital’s status, making it the go-to custodian for major institutions such as BlackRock and Cantor Fitzgerald.

But the favorable climate was short-lived. New OCC leadership ushered in a regulatory clampdown, freezing new trust bank applications for digital assets overnight—leaving Anchorage as the sole survivor and stalling the field for more than three years.

Now, with Trump and crypto-friendly officials in power, Jonathan Gould—who previously served as chief legal officer at Bitfury—has become acting OCC head and begun rolling back Biden-era restrictions on crypto banking.

This month, Gould’s appointment signaled a subtle reopening of the compliance window, sparking renewed interest from entrepreneurs, funds, and projects eager to secure new licenses.

The Endgame: Accessing the Fed’s Settlement System

For crypto players, just having a National Trust Bank Charter isn’t enough—the ultimate goal is a “Fed master account” and direct access to the Federal Reserve’s settlement rails.

This is the industry’s holy grail.

With direct access to the Fed, crypto firms could hold stablecoin reserves at the central bank—removing dependence on third-party banks and granting full access to the U.S. financial system as recognized equals rather than outsiders.

The industry knows this is “true legitimacy”—a transition from outsider status to recognized, regulated member of the U.S. financial system. That’s why Circle, Ripple, Anchorage, and Paxos are all doubling down on both federal trust bank licenses and Fed master account applications.

But the Fed, mindful of financial stability (e.g., sudden large-scale liquidations) and compliance risks like money laundering or illicit flows, hasn’t yet approved any crypto firm’s master account application. Even Anchorage, with its trust bank charter, has yet to gain this approval.

So, who else is racing for a charter?

Circle submitted its application in late June 2025 to launch First National Digital Currency Bank, N.A., for direct USDC reserve custody and institutional services.

Ripple followed in early July, announcing both a federal trust bank and a Fed master account application—intent on lodging RLUSD reserves at the central bank.

Legacy custodian BitGo is awaiting OCC approval, and is designated for “Trump USD1” reserve custody.

Other contenders include Wise (formerly TransferWise), which has applied for a non-depository trust charter, and Erebor, which aims to serve AI, crypto, and defense startups. Earlier efforts like First Blockchain Bank and Trust were shelved during the Biden administration’s regulatory clampdown, while Fidelity Digital Assets’ intentions remain unconfirmed.

Should Circle, Ripple, or BitGo secure these licenses, they’ll bypass state-level hurdles, operate across the U.S., and potentially access the Fed’s settlement system—enabling stablecoins to be held in the Fed and matching Wall Street’s settlement and custody capabilities.

The regulators remain both hopeful and cautious about crypto’s entry into banking. OCC leadership changes and a friendlier policy climate offer a window, but these licenses still don’t permit full banking activities such as accepting retail deposits or making loans.

The window of opportunity is open, but the bar remains high. Who will be first to open the door to the Fed? This will be a significant development in the relationship between Wall Street and crypto leaders—and could decide the shape of global finance for the next decade.

For the crypto industry, with stablecoins formally onshore and banks officially in the game, the parallel universes of crypto and Wall Street are converging under the light of transparent regulation. Once the subject of heated debate, crypto assets are fast becoming mainstream. They are now appearing on everyday U.S. customer accounts and on the balance sheets of global financial institutions.

Disclaimer:

- This article is reprinted from [BLOCKBEATS] and copyrights belong to the original authors [律动小工, kkk]. For any copyright concerns regarding this reprint, please contact the Gate Learn team, and we will address your request promptly according to relevant procedures.

- Disclaimer: The views and opinions expressed in this article are solely those of the author and do not constitute investment advice.

- Other language versions of this article have been translated by the Gate Learn team. Do not copy, distribute, or use any translated version without expressly referencing Gate.