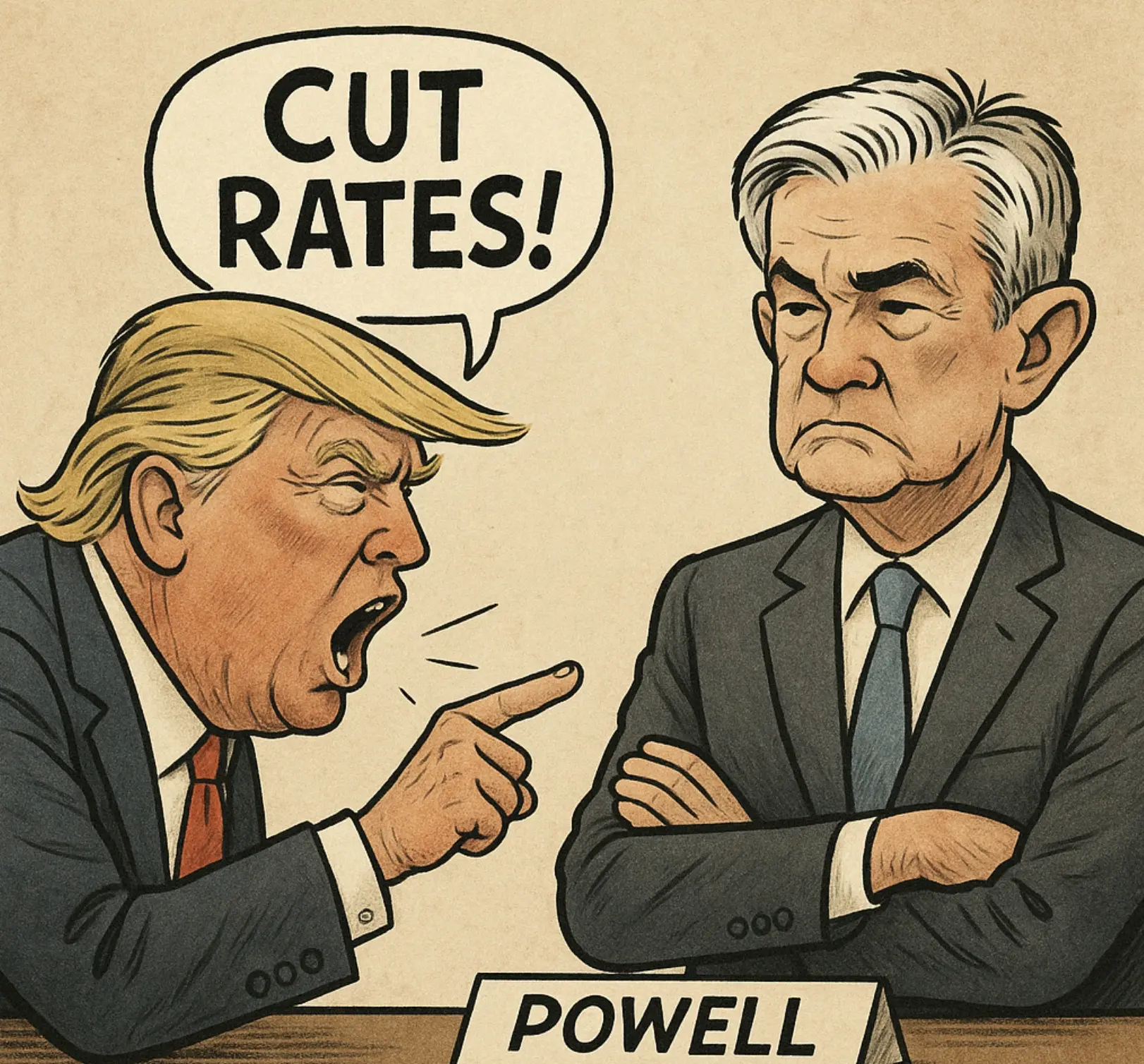

Seven Years of Tension: Trump Pressures Powell — What Will the Resignation Storm Bring?

Can a renovation controversy unseat the Federal Reserve Chair?

Trump began criticizing Powell during the election campaign and is now leveraging the renovation dispute as a new basis for exerting pressure. This political standoff is driving global market sentiment toward a critical point.

What pressures does Powell currently face? If he is compelled to resign, what potential shocks could this trigger in the markets?

Trump and Powell: Seven Years of Conflict

The core of the Trump-Powell dispute is straightforward: Trump seeks interest rate cuts, while Powell resists. This fundamental disagreement has persisted since 2018.

Notably, Trump initially selected Powell for the role. In February 2018, Powell became Federal Reserve Chair following Trump’s nomination, as Trump hoped for accommodative monetary policy to support economic growth.

In October 2018, Trump publicly criticized Powell for raising interest rates too quickly, labeling him as “the biggest threat” and even calling him “crazy.” Their conflict became public, and Trump continued to apply pressure, engaging in public disputes with Powell.

In 2022, President Biden nominated Powell for a second term, extending his chairmanship to May 2026. As the 2024 election approached, tensions escalated. Throughout the campaign and thereafter, Trump repeatedly accused Powell of “acting too slowly” and “failing to cut rates.” In recent months, Trump has called for Powell’s resignation on numerous occasions.

However, replacing the Federal Reserve Chair is not a simple matter. Under U.S. law, the President cannot remove the Chair over policy disagreements without evidence of illegality or gross misconduct.

In July, a potential opening emerged. Trump’s team introduced a new strategy: Trump requested that Congress investigate Powell for “political bias” and “false testimony to Congress,” alleging significant violations in the Federal Reserve headquarters renovation project overseen by Powell.

During this period, rumors circulated that Powell was considering resignation, causing the situation to escalate rapidly. After seven years of this conflict, it has reached a critical juncture.

Powell’s Policy Dilemma: A Challenging Monetary Policy Environment

Former Federal Reserve economist Robert Hetzel stated directly, “The Fed is boxed in.”

Powell currently faces a highly challenging monetary policy environment: Trump’s tariff policies may increase inflationary pressures, while the labor market is already showing signs of cooling. This dual threat complicates decision-making for Powell and the Federal Reserve.

If the Federal Reserve cuts rates prematurely, consumer inflation expectations could become unanchored. Conversely, raising rates to control inflation could trigger volatility in the bond market, surging yields, or even financial instability.

Beyond these economic challenges, Powell is also facing intense political pressure. In response, he requested that the Inspector General continue reviewing the headquarters renovation project and, in a rare move, used the Federal Reserve’s website to publish a detailed explanation of the cost increases, refuting claims of “luxury renovations.”

Amid mounting economic and political challenges, Powell is experiencing one of the most difficult periods of his tenure.

Potential Consequences If Powell Resigns

If Powell resigns under pressure, the stability that underpins global market pricing could be undermined.

George Saravelos, Global Head of FX Strategy at Deutsche Bank, stated that if Trump were to force Powell’s departure, the Trade-Weighted U.S. Dollar Index could fall by 3%–4% within 24 hours, and fixed income markets could experience a 30–40 basis point increase in yields. U.S. dollar assets would carry a persistent risk premium, and investors might become concerned that the Federal Reserve’s currency swap lines with other central banks could become politicized.

Saravelos further noted, “Even more concerning is the current fragile state of U.S. external financing, which could result in even more severe and disruptive price volatility than anticipated.”

The ING strategy team led by Padhraic Garvey reported that while an early Powell departure is unlikely, such an event would likely steepen the U.S. Treasury yield curve, as investors would anticipate lower interest rates, faster inflation, and diminished Federal Reserve independence. They added that this would create a “toxic combination” for the U.S. dollar.

Cryptocurrency market commentator Phyrex offered a risky asset perspective. Even if Trump successfully replaces Powell, it does not guarantee control over the Federal Reserve. If inflation resurges, any new Chair would be compelled to return to a tightening path. Should the Federal Reserve begin cutting rates in September while the economy remains stable and unemployment is low, risky assets, including the crypto market, could see a short-term boost. However, with rates still at 4.5%, there remains substantial liquidity to unwind.

Any indication of instability in Powell’s position can trigger market volatility. This situation is not solely a dispute over monetary policy; it represents a significant conflict regarding power and central bank independence.

Disclosure:

- This article is republished from [ChainCatcher], with copyright belonging to the original author [Fairy, ChainCatcher]. If you object to this republication, please contact the Gate Learn Team. We will address your concerns promptly in accordance with our procedures.

- Disclaimer: The views and opinions expressed in this article are solely those of the author and do not constitute investment advice of any kind.

- Other language versions of this article were translated by the Gate Learn team. Unless Gate is expressly referenced, no translated content may be copied, redistributed, or plagiarized.