Michael Saylor: The Transformation of Bitcoin’s Most Devoted Believer

Who is Michael Saylor?

(Source: saylor)

Michael Saylor is widely recognized as one of Bitcoin’s biggest bulls in the crypto community. As the co-founder and Executive Chairman of MicroStrategy, a US business intelligence software firm, Saylor made headlines in 2020 with MicroStrategy’s large-scale Bitcoin purchase using company assets, impacting both traditional finance and the Web3 community.

Saylor is more than just a visionary entrepreneur; he is a vocal advocate of Bitcoin as digital gold and a tool for human financial freedom. His statements and social media posts often influence crypto community sentiment and market trends.

Background and Entrepreneurial Journey

Born in 1965, Michael Saylor graduated from MIT with a major in Aerospace Engineering and Science. He founded MicroStrategy in 1989, focusing on enterprise data analytics and business intelligence software. During the dot-com boom of 2000, the company’s market capitalization soared, but it later faced challenges, including financial restatement issues and a sharp decline in stock price. Despite these headwinds, Saylor led MicroStrategy through a successful transformation, maintaining its competitiveness in the analytics market. What truly cemented Saylor’s place in Web3 history, however, was MicroStrategy’s strategic pivot to Bitcoin starting in 2020.

MicroStrategy’s Strategic Bet

In August 2020, MicroStrategy publicly announced it would convert a portion of its cash reserves into Bitcoin, making its initial purchase of $250 million. Saylor stated at the time, “Fiat currency is rapidly depreciating, and Bitcoin is the best store of value we’ve found.” Since then, MicroStrategy has repeatedly increased its Bitcoin holdings, even raising funds through convertible bond offerings to acquire more. By mid-2025, the company’s Bitcoin holdings exceeded 600,000 coins, with an average cost well below current market prices, making it the largest publicly traded corporate Bitcoin holder in the world.

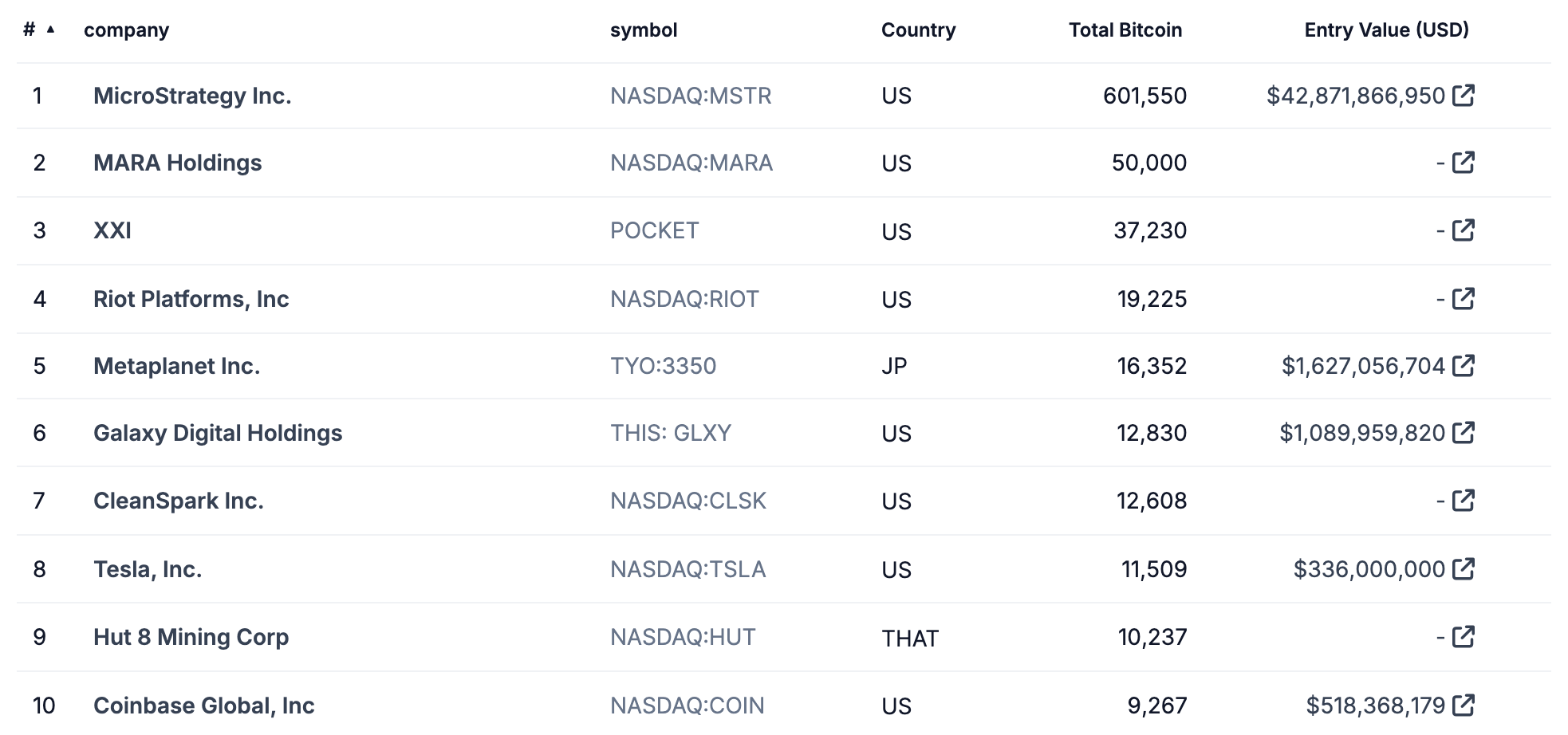

(According to data from coingecko, MicroStrategy continues to hold the top corporate position in Bitcoin ownership.)

Michael Saylor’s Crypto Views and Beliefs

Saylor’s perspective on Bitcoin goes far beyond treating it as an asset. He sees Bitcoin as a technology for financial freedom—a currency designed to resist inflation, evade censorship, and counter both devaluation and sovereign monetary control. In numerous speeches, he’s asserted, “Bitcoin is humanity’s hope around the globe—it’s the wealth-preservation tool for the digital era.” Saylor has long advocated against holding cash, arguing that dollar-denominated assets are eroding in value, and he warns that companies refusing to embrace Bitcoin risk being left behind by history. These convictions have prompted many institutions and entrepreneurs to reevaluate the significance of crypto assets.

Public Speaking and Community Influence

Saylor is an active figure in the crypto world, with over 4 million followers on X (formerly Twitter). He frequently comments on Bitcoin price trends, macroeconomic developments, and motivational topics, and he’s a regular participant in Bitcoin conferences and major media interviews. Bitcoin for Corporations is an online event he launched, which teaches CFOs how to integrate Bitcoin into corporate finance strategies. These efforts have substantially raised Bitcoin’s legitimacy in mainstream capital markets.

Facing Criticism

Although Saylor commands respect from many Web3 proponents, he still faces skepticism from traditional media and investors. Critics claim he’s tied a public company too closely to a volatile asset, and some argue he’s made extreme bets with shareholder capital. However, based on historical Bitcoin price trends, MicroStrategy’s Bitcoin strategy still results in positive returns. Saylor remains steadfast, continually emphasizing his long-term conviction and focus on long-term value, insisting that Bitcoin is the core digital asset of the 21st century.

Saylor and His Impact on the Web3 Ecosystem

Saylor’s influence now extends well beyond entrepreneurship. He’s a leading advocate for Bitcoin education, regulatory dialogue, and financial liberty. His impact spans support for the Web3 Foundation, decentralized protocols, and global Bitcoin awareness. As a result of his leadership, Bitcoin is transforming from merely a crypto safe-haven asset into a recognized mainstream asset. This shift is accelerating the fusion of Web3 and traditional finance.

If you would like to learn more about Web3, please register here: https://www.gate.com/

Conclusion

Michael Saylor’s story exemplifies the journey from engineer and entrepreneur to a representative figure of the crypto era. Leading a company toward a Bitcoin safe-haven asset status is not just a financial strategy but also reflects contemporary values. In today’s climate of information overload and asset volatility, Saylor’s belief in Bitcoin represents a concrete approach to countering fiat inflation and achieving financial autonomy.