BTC Recupera los $100,000, ETH se dispara un 16% en un día, Superstate avanza acciones tokenizadas registradas en la SEC | Investigación de Gate

Visión general del mercado de criptomonedas

BTC (+3.3% | Ahora en $102,934)

Impulsado por la disminución de las preocupaciones sobre la política arancelaria, BTC subió más del 3,3% en las últimas 24 horas. El precio ha estado subiendo constantemente dentro de un canal ascendente, alcanzando un pico de $104,241. Técnicamente, el patrón de velas muestra una fuerte alineación alcista, con la acción del precio manteniéndose por encima de promedios móviles a corto plazo. El indicador MACD permanece en un cruce alcista, con barras de histograma cada vez más amplias que indican un impulso de compra sostenido. Una ruptura por encima de la resistencia del canal podría abrir la puerta para probar el nivel psicológico de $105,000 a corto plazo. Por otro lado, la incapacidad de superar niveles más altos puede llevar a una corrección hacia la zona de soporte de $102,000–$100,000. En general, la tendencia sigue siendo alcista, con un enfoque en si el volumen creciente puede sostener la tendencia alcista.

ETH (+16.21% | Ahora en $2,214)

ETH aumentó más de un 16% en las últimas 24 horas, alcanzando un máximo de $2,243.98. El precio se está moviendo de forma constante dentro de un canal ascendente, con medias móviles a corto plazo alineadas al alza. ETH está operando muy por encima de sus medias móviles de 5, 10 y 30 períodos, subrayando una clara tendencia alcista. El MACD sigue en un cruce alcista con barras de histograma crecientes, reflejando una fuerte presión de compra. Una ruptura por encima del límite superior del canal podría apuntar a $2,300 a corto plazo, mientras que un retroceso podría ver el soporte probado en el rango de $2,150–$2,100. Monitorear las tendencias de volumen sigue siendo clave para confirmar si el rally puede extenderse más.

ETFs

Según Farside Investors, los ETF de Bitcoin spot en EE. UU. registraron una entrada neta de $117 millones el 8 de mayo, [3] mientras que los ETF de Ethereum spot en EE. UU. vieron una salida neta de $16.1 millones. [4]

Altcoins

A partir de las 6:30 (UTC) del 9 de mayo, los sectores con temática de rana, Ether.fi Ecosystem y PolitiFi registraron ganancias del 32.1%, 27% y 25.8%, respectivamente. [5]

Acciones de EE. UU.

El 8 de mayo, las acciones estadounidenses cerraron al alza en general, con el S&P 500 subiendo un 0.58%, el Dow Jones Industrial Average ganando un 0.62%, y el Nasdaq Composite avanzando un 1.07%. [6]

Oro al contado

El oro se negoció a $3,282.78 por onza, bajando un 0.69% en el día (a partir de las 2:30 AM UTC del 9 de mayo). [7]

Índice de Miedo y Avaricia

El índice se sitúa en 73 (Avaricia), reflejando un sentimiento ampliamente optimista. Las correcciones actuales se ven más como consolidaciones técnicas y posicionamientos cautelosos antes de los próximos lanzamientos de datos macroeconómicos. [8]

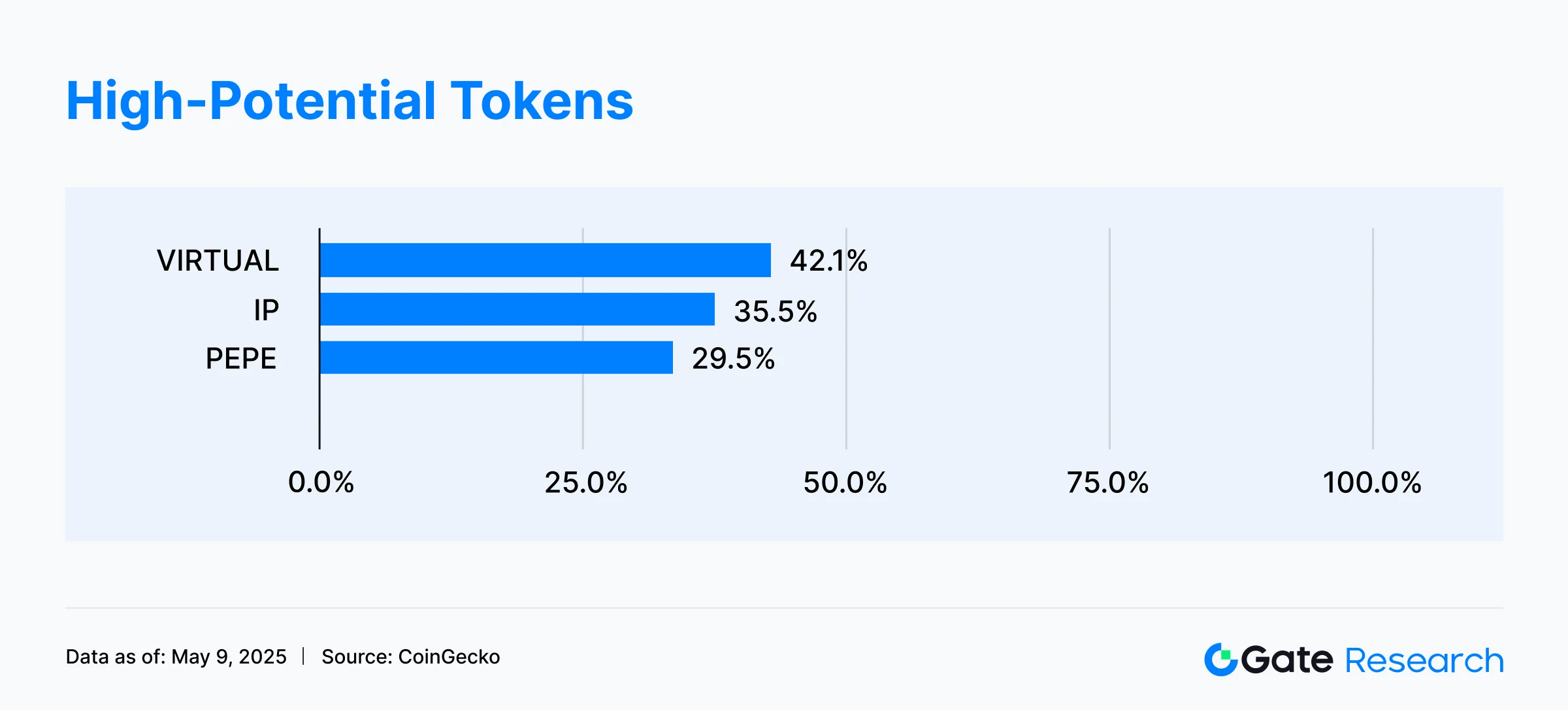

Tokens de alto potencial

VIRTUAL— Protocolo Virtuals (+42.1%, Capitalización del mercado circulante $1.326B)

Resumen del Token

VIRTUAL es el token nativo del Protocolo Virtuals, una red descentralizada para negociar derivados de activos virtuales. La plataforma permite a los usuarios fijar libremente precios y comerciar eventos, activos y flujos de datos dentro de mundos virtuales. Combina mecanismos de derivados on-chain con características de interacción social. Se enfoca en dos conceptos clave: "activos virtuales negociables" y "mercados de predicción gamificados."

Perspectivas del mercado

El protocolo está implementando activamente implementaciones multi-cadena, refinando modelos de valoración de activos virtuales e implementando mecanismos de gobernanza comunitaria. Estas actualizaciones son ampliamente vistas como mejoras en la funcionalidad, escalabilidad y participación del usuario de la plataforma, lo que solidifica aún más su posición como una capa fundamental en las finanzas virtuales Web3. Los inversores son optimistas de que estos desarrollos respaldarán el crecimiento del valor a largo plazo de VIRTUAL.

IP— Protocolo de Historias (+35.5%, Capitalización de Mercado Circulante $1.423B)

Descripción del Token

IP es el token nativo de Story Protocol, un proyecto que reimagina cómo se crea, gestiona y monetiza la propiedad intelectual. Proporciona una infraestructura IP Web3 abierta y modular que permite a los creadores registrar obras en cadena, rastrear su evolución y habilitar la colaboración y la remezcla a través de mecanismos de permiso, amplificando los efectos de red alrededor del contenido.

Perspectiva del mercado

Respaldado por varios VCs prominentes, Story Protocol planea expandir su marco de derechos de autor en cadena, modelos de reparto de ingresos e integración de contenido entre plataformas. El mercado ve estas iniciativas como una forma efectiva de abordar los puntos críticos en la gestión tradicional de la PI y capacitar a los creadores para desbloquear un valor sostenido en un paisaje descentralizado, impulsando la creciente demanda y apreciación del precio del token de PI.

PEPE — Pepe (+29.5%, Capitalización de mercado circulante $4.6B)

Visión general de Token

PEPE es una criptomoneda impulsada por memes inspirada en el icónico personaje de Internet "Pepe the Frog". Desde su lanzamiento, ha ganado rápidamente tracción con un fuerte impulso de la comunidad y una difusión viral. Sin pre-minado ni asignación de equipo, el proyecto es completamente impulsado por la comunidad, enfatizando la descentralización y el valor de entretenimiento.

Perspectiva del mercado

El rally de PEPE está impulsado por el creciente sentimiento en todo el sector de las monedas meme. El proyecto está avanzando activamente en la gobernanza de la comunidad y explorando cruces con IPs de memes principales para expandir su presencia en el ecosistema de entretenimiento Web3. Se espera que estos movimientos estratégicos refuercen la cohesión de la comunidad, atraigan más atención y proporcionen catalizadores adicionales al alza para el token.

Alpha Data

La capitalización de mercado de Bitcoin recupera los 2 billones de dólares, supera a Google para convertirse en el sexto activo global más grande

Métricas clave

La capitalización de mercado de Bitcoin (BTC) ha recuperado la marca de los $2 billones, situándose actualmente en $2.036 billones, un aumento del 3.27% en las últimas 24 horas. Ha superado al gigante tecnológico Google, escalando al sexto puesto entre los activos más grandes del mundo por valor de mercado. Esto marca el primer regreso de Bitcoin por encima de los $100,000 en tres meses, estableciendo un nuevo máximo desde principios de febrero. Mientras tanto, la capitalización de mercado total de las criptomonedas también ha repuntado fuertemente a $3.22 billones, subiendo un 2% en las últimas 24 horas, lo que indica una recuperación sostenida en el sentimiento general del mercado.

Análisis

El resurgimiento de Bitcoin por encima de los $2 billones y el nivel de $100,000 está respaldado por dos importantes vientos macroeconómicos. En primer lugar, el presidente de la Fed, Jerome Powell, señaló posibles recortes de tasas de interés más adelante este año, al tiempo que destacaba los riesgos continuos de inflación y desempleo. Las persistentes presiones inflacionarias están llevando a los inversores hacia activos que protegen contra la inflación, con Bitcoin —el llamado “oro digital”— recuperando su favor. En segundo lugar, el ex presidente de Estados Unidos, Donald Trump, anunció públicamente esfuerzos para avanzar en un acuerdo arancelario con el Reino Unido. Combinado con las próximas conversaciones comerciales entre Estados Unidos y China, estos desarrollos han impulsado el apetito por el riesgo global y han estimulado los flujos de capital hacia activos de alta volatilidad, incluidas las criptomonedas.

Rumble Q1 Revenue Rises 34% as It Bets on Crypto Wallet to Challenge Coinbase

Métricas Clave

La plataforma de intercambio de videos Rumble (Nasdaq: RUM) reportó ingresos del primer trimestre de 2025 de $23.7 millones, un aumento del 34% interanual, impulsado por el crecimiento de suscripciones y una monetización mejorada. A pesar de una disminución en los usuarios activos mensuales a 59 millones, la retención de usuarios después de las elecciones en EE. UU. se situó en el 87%, superando con creces la tasa de retención del 60% tras las elecciones de medio término de 2022. La pérdida neta se redujo a $2.7 millones, con una pérdida ajustada de EBITDA de $22.7 millones. El ingreso promedio por usuario (ARPU) fue de $0.34, una disminución del 13% con respecto al trimestre anterior. A finales de marzo, Rumble tenía $319 millones en activos líquidos, incluidos $301 millones en efectivo y 210 Bitcoin (aproximadamente $17.4 millones).

Análisis

Rumble logró un fuerte crecimiento en el primer trimestre de 2025, respaldado por la expansión de sus servicios en la nube y el desarrollo de negocios internacionales. La empresa cerró un acuerdo de servicios en la nube con El Salvador y recibió una inversión estratégica de Tether, fortaleciendo significativamente su balance. Rumble también planea lanzar una billetera de criptomonedas no custodial, Cartera Rumble, en el tercer trimestre en asociación con Tether. La billetera admitirá Bitcoin y stablecoins, posicionándose como un competidor directo de Coinbase. Concurrentemente, Rumble está expandiendo su ecosistema de contenido, incorporando la Casa Blanca y el influyente prominente Tim Pool, y co-presentando una demanda con Trump Media Group contra un juez brasileño para afirmar los derechos de libertad de expresión. También se ha asociado con los Tampa Bay Buccaneers y Rebel News para diversificar aún más su negocio de servicios en la nube. [10]

El volumen mensual de negociación de stablecoins alcanza un récord de $1.82 billones

Métricas Clave

El volumen de transacciones de monedas estables se disparó a un récord de $1.82 billones el mes pasado, destacando su creciente utilidad en el mundo real en el mercado de criptomonedas. A pesar de la alta volatilidad en el comercio de criptomonedas en general, el uso orgánico y no especulativo de monedas estables sigue aumentando, reflejando su creciente papel en pagos, liquidaciones y flujos de capital. Es probable que el mercado aún subestime el potencial a largo plazo y el valor sistémico de las monedas estables.

Análisis

Los volúmenes récord de stablecoins no están impulsados únicamente por la especulación, sino que apuntan a la expansión de aplicaciones del mundo real. Los impulsores clave incluyen la creciente demanda de pagos transfronterizos, un resurgimiento de los ecosistemas DeFi, un mayor uso de stablecoins como activos principales, la demanda de refugio seguro durante la incertidumbre económica global, una mayor participación institucional, productos innovadores de stablecoin y una mejora en la infraestructura en cadena que reduce los costos de transacción y mejora la velocidad. En resumen, las stablecoins están evolucionando de instrumentos especulativos a una infraestructura crítica para la economía digital.

Alpha Insights

Superstate lanza el "Opening Bell" para permitir que los valores registrados en la SEC se negocien en la cadena

Visión general

Superstate ha reveladoApertura de la campanauna plataforma diseñada para facilitar la emisión y negociación de acciones registradas en la SEC directamente en la cadena de bloques. La iniciativa planea debutar en la red Solana, creando una integración nativa entre los mercados de acciones tradicionales y la infraestructura de la cadena de bloques. Superstate colaboró recientemente con varias instituciones para presentar una propuesta de marco a la SEC.Campana de apertura tiene como objetivo permitir a los emisores evitar los intercambios centralizados tradicionales (CEXs) y los procesos de listado convencionales, aprovechando los rieles blockchain para el trading continuo y el liquidación en tiempo real. Se espera que las Estrategias SOL, apodadas "el MicroStrategy de Solana", sean de las primeras en embarcar sus acciones comunes a través de la plataforma. [12]

Análisis

El movimiento de Superstate para permitir que los valores registrados en la SEC se emitan y negocien de forma nativa en Solana lo posiciona como un líder y proveedor clave de infraestructura en el espacio de tokenización de seguridad cumplidor. Al desplegarse en la cadena de alto rendimiento de Solana, Superstate podría atraer a instituciones financieras tradicionales y emisores que buscan soluciones de negociación eficientes y de bajo costo. La plataforma tiene el potencial de unir la cripto y la finanza tradicional, atraer más capital institucional a los activos digitales, acelerar la alineación regulatoria y sentar las bases para futuros productos financieros innovadores.

Bridge lanza USDB, una stablecoin centrada en los desarrolladores respaldada 1:1 por efectivo y el fondo del mercado monetario de BlackRock

Visión general

La plataforma de pagos Bridge ha introducido USDB, una stablecoin creada específicamente para desarrolladores. Respaldado 1:1 por efectivo y el Fondo del Mercado Monetario de BlackRock, USDB ofrece garantías de seguridad tanto on-chain como off-chain e integración de API sin problemas. USDB permite una conversión sin fricciones con USDC, y los desarrolladores pueden ganar recompensas al mantener USDB. Los primeros adoptantes ya están aprovechando USDB para construir productos que abarcan la gestión del tesoro, cuentas integradas y pagos internacionales.

Análisis

Bridge está abriendo un nicho en el mercado de stablecoins al dirigirse a casos de uso centrados en los desarrolladores. El enfoque de USDB en las necesidades de los desarrolladores señala una tendencia más amplia donde las stablecoins sustentarán las finanzas integradas, los flujos de pagos automatizados y otras aplicaciones avanzadas, acelerando la adopción generalizada en la industria de las criptomonedas y la economía digital. Su respaldo en efectivo y en el fondo de BlackRock también puede impulsar la confianza del mercado en las stablecoins de próxima generación y diversificar aún más el panorama de las stablecoins.

Proyecto de ley sobre moneda estable falla por poco en el Senado, quedándose corto con 49-48 votos

Visión general

Un proyecto de ley de regulación de las stablecoins se ha estancado en el Senado de EE.UU., fracasando por poco en una votación de 49-48 el jueves, quedando por debajo de los 60 votos necesarios, en gran parte debido a la oposición demócrata. No obstante, es posible que ambas partes lleguen a un compromiso en las próximas semanas. Varios senadores demócratas enfatizaron que la supervisión de las stablecoins es fundamental para la protección del consumidor y la regulación de la industria. Mientras tanto, la senadora Elizabeth Warren y otros expresaron fuertes objeciones a la campaña promocional de "fichas por cena" de los organizadores de tokens de TRUMP. [14]

Análisis

Aunque el proyecto de ley enfrentó un revés inicial, las negociaciones regulatorias están lejos de terminar. Un compromiso bipartidista en las próximas semanas sigue siendo plausible y es crucial para la perspectiva a largo plazo del mercado de stablecoins. Un marco regulatorio claro y equilibrado reduciría la incertidumbre, atraería a inversores institucionales y jugadores de TradFi, y desbloquearía una adopción más amplia de las stablecoins en pagos y liquidaciones. Sin embargo, a corto plazo, es probable que la incertidumbre regulatoria alimente la volatilidad continua del mercado.

Actualizaciones de recaudación de fondos

Según RootData, cinco proyectos anunciaron públicamente rondas de financiación en las últimas 24 horas, abarcando CeFi, aplicaciones de consumidores y DeFi, con un financiamiento total divulgado que supera los $2.92 mil millones. Aquí están los tres principales acuerdos: [15]

Deribit

Adquirido por Coinbase por $2.9 mil millones

El intercambio de opciones de criptomonedas Deribit ha sido adquirido por Coinbase por $2.9 mil millones, que comprende $700 millones en efectivo y 11 millones de acciones de acciones comunes de clase A de Coinbase. El precio final de la transacción estará sujeto a ajustes habituales, y se espera que el cierre del acuerdo sea a finales de año. Fundado en 2016, Deribit es la primera plataforma de opciones de criptomonedas del mundo y actualmente controla más del 80% del mercado global de opciones de criptomonedas. Constantemente se encuentra entre los 10 primeros a nivel mundial en volumen de operaciones y interés abierto en futuros. Coinbase tiene como objetivo integrar los negocios de trading spot, futuros y opciones a través de la adquisición, construyendo un ecosistema integral de trading de activos criptográficos.

T-REX

Recauda $17 millones en la presemilla liderada por Portal Ventures

La plataforma de entretenimiento para consumidores Web3 T-Rex recaudó $17 millones en una ronda pre-seed liderada por Portal Ventures, Framework Ventures y Arbitrum Gaming Ventures. Construido por el estudio de productos Web3 EVG, la plataforma T-Rex cuenta con una cadena de bloques optimizada para aplicaciones de consumidores. Incluye un motor de distribución incorporado (a través de una extensión de Chrome) para rastrear el compromiso del usuario en X, TikTok, YouTube y otras plataformas, abordando los desafíos de adquisición de usuarios de Web3. Los mecanismos de gobernanza del protocolo, desde las tarifas de gas hasta el consenso, están diseñados para casos de uso de calidad para el consumidor.

GoQuant

Recauda $4 millones en ronda inicial liderada por GSR

El proveedor de infraestructura de negociación de activos digitales GoQuant anunció una ronda de financiación inicial de $4 millones liderada por GSR. La financiación acelerará el desarrollo de su sistema de ejecución de negociación de baja latencia y expandirá sus líneas comerciales institucionales. GoQuant se dedica a construir infraestructura para activos digitales, con un enfoque en mejorar la accesibilidad y eficiencia en los ecosistemas de blockchain. Su plataforma ofrece análisis avanzados, protocolos de seguridad y soluciones integradas para servir a una amplia gama de participantes en el espacio de activos digitales.

Aspectos destacados del Airdrop

Miden

Miden es una solución de escalado de capa 2 de Ethereum desarrollada por Polygon, aprovechando la tecnología zk-STARKs para mejorar la escalabilidad y seguridad de Ethereum. A finales de abril, Miden completó una ronda de financiación inicial de $25 millones, liderada por a16z, Hack VC y 1kx. El proyecto planea asignar el 10% de su futuro suministro de tokens a los titulares de tokens de Polygon.

Cómo participar

- Instala la Billetera Miden desde la Tienda Web de Chrome. [17]

- Reclamar tokens de la red de prueba. [18]

- Interactúa con la billetera transfiriendo tokens de prueba y realizando transacciones. [19]

Recordatorio

Los planes de distribución gratuita y los métodos de participación están sujetos a cambios en cualquier momento. Se recomienda a los usuarios seguir los canales oficiales de Miden para conocer las últimas actualizaciones. La participación conlleva riesgos, y los usuarios deben realizar una investigación exhaustiva antes de participar. Gate.io no garantiza la distribución de futuras recompensas por distribución gratuita.

Referencias:

- Gate.io, https://www.gate.io/trade/BTC_USDT

- Gate.io, https://www.gate.io/trade/ETH_USDT

- Inversores de Farside, https://farside.co.uk/btc/

- Inversores de Farside, https://farside.co.uk/eth/

- CoinGecko, https://www.coingecko.com/categories

- Invertir, https://investing.com/indices/usa-indices

- Invertir, https://investing.com/currencies/xau-usd

- Gate.io, https://www.gate.io/bigdata

- 8MarketCap, https://8marketcap.com/

- GlobeNewswire, https://www.globenewswire.com/news-release/2025/05/08/3077703/0/en/Rumble-Reports-First-Quarter-2025-Results.html

- X, https://x.com/cryptounfolded/status/1920485766108459309

- El Bloque, https://www.theblock.co/post/353344/superstate-unveils-opening-bell-to-bring-SEC-registered-equities-onchain-starting-with-Solana?utm_source=twitter&utm_medium=social

- X, https://x.com/Stablecoin/status/1920533471044513945

- Jin10, https://flash.jin10.com/detail/20250509025016803800

- Rootdata, https://www.rootdata.com/Fundraising

- Miden, https://miden.fi/

- chrome webstore, https://chromewebstore.google.com/detail/miden-wallet/ablmompanofnodfdkgchkpmphailefpb?hl=zh-CN&utm_source=ext_sidebar

- Miden Faucet, https://faucet.testnet.miden.io/

- Miden Wallet, https://miden.leo.app/send

Investigación de Gatees una plataforma completa de investigación de blockchain y cripto que brinda a los lectores contenido detallado, incluyendo análisis técnico, ideas candentes, revisiones de mercado, investigación de la industria, pronósticos de tendencias y análisis de políticas macroeconómicas.

Descargo de responsabilidad

Invertir en el mercado de criptomonedas implica un alto riesgo, y se recomienda que los usuarios realicen investigaciones independientes y comprendan completamente la naturaleza de los activos y productos que están adquiriendo antes de tomar cualquier decisión de inversión. Gate.io no se hace responsable de las pérdidas o daños causados por dichas decisiones de inversión.

Artículos relacionados

¿Cómo hacer su propia investigación (DYOR)?

¿Cómo apostar ETH?

¿Qué es el análisis fundamental?

Las 10 principales plataformas de comercio de monedas MEME

Guía para principiantes en el comercio